- 15 Posts

- 181 Comments

1·3 months ago

1·3 months agodeleted by creator

2·3 months ago

2·3 months agoIn the last two months, Nostr users alone (decentralized twitter clone like Mastodon) sent each other 2.6 million tips (individual transactions) over Bitcoin lightning. In that same time period, Bitcoin main chain did around 20-40k. Most transactions are on lightning by number of transactions. Maybe not by total value moved, but lightning is pretty opaque and grants additional privacy, so it’s hard to measure for that reason.

Lightning continues to grow and get upgrades (look up BOLT12 if you are curious about the latest upgrades which bring additional privacy enhancements).

121·3 months ago

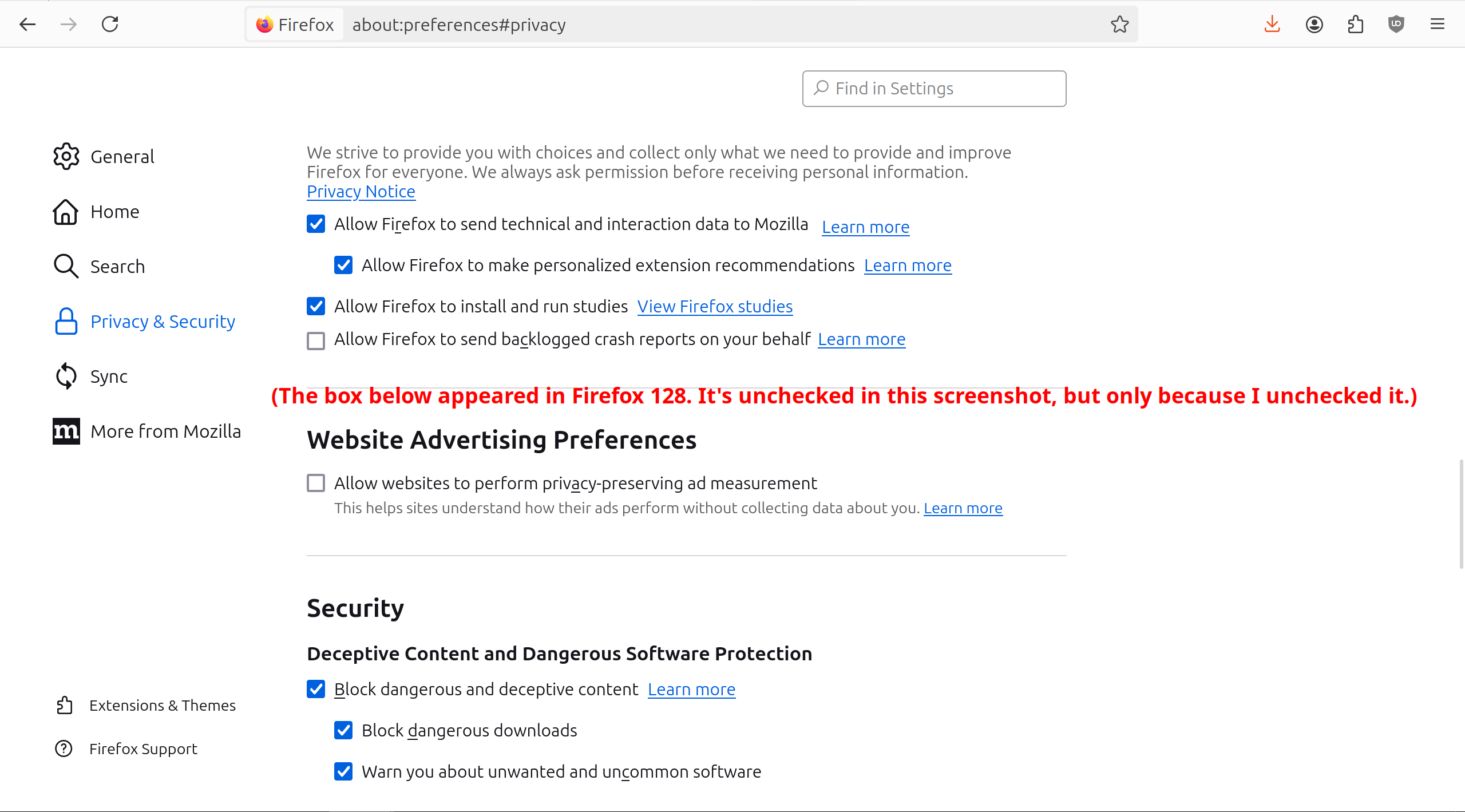

121·3 months agoIt’s open source, and it’s fully self-custody which are two important features. Having a wallet directly integrated into the e-mail client is nice, being able to send payments to other users just knowing their e-mail address instead of their public key is pretty cool. It does automatic address rotation to preserve privacy. Wish it supported lightning for cheaper/faster transactions and additional privacy but hopefully that feature comes in time.

2·3 months ago

2·3 months agoIt’s a self-custody wallet and open source. It’s regular main-chain BTC but it does automatic address rotation. Unfortunately it doesn’t support lightning, which is where the majority of Bitcoin transactions occur. Lightning offers significantly increased privacy, sub-second transactions and fees measuring in pennies.

You may know me as a Bitcoin educator and engineer.

Yeah well, in that case, fuck you and the hypercapitalist horse you rode in on.

This guy is a protocol engineer, talking about protocols. You may not like like Bitcoin, but it’s pretty hard to argue it’s not one of the most successful, widely-used, and forked open source protocols developed in the last several decades. Bitcoin core is in the top 100 starred repos on Github. It has a unicode character.

Bitcoin’s market cap (> 1 trillion USD) is bigger than Sweden’s GDP and it moves billions of dollars around the world every year. You can use it to send money to anybody with a phone and a halfway reliable internet connection in under a second for pennies in fees, and it settles instantly. And it’s been working for 15 years without a single hour of downtime, bank holiday, or hack despite pandemics, wars, financial crises, and attempted bans by global powers.

Like, be mad if you want, but it’s a pretty successful and robust protocol. And if you don’t like it, you can fork it and change it, because it’s open source.

Sure, you can run one, good luck getting even a halfway decent delivery rate to mailboxes at any major mail provider. Even if they never receive a spam message from your server, your server is an “unknown” which counts against you. And if one person in your small company of 10 or 100 or even 1000 people gets their e-mail hacked and sends spam? Prepare for the rest of them to get punished for it. Running an SMTP server is a nightmare which is why, over time, more and more of the economy has just shifted their SMTP servers to organizations who professionally run SMTP servers instead of having their own.

It would be annoying to lose your instance, true, but you just move to another or roll your own.

This is a problem nostr solved, and I believe bluesky solves as well though idk as much about the protocol. On nostr, your identity and your instance are different things. Relay goes down? There’s no meaningful impact to you. You’re typically connected to several, each of which store your content. You identity isn’t username@somerelay dot com, it’s just username.

As a user, I had this happen to me early in mastodon and it was very frustrating to lose all my follows, followers, tweets, settings, etc. I realize there’s now ways to manually backup etc but properly moving an account requires a cooperative instance which can’t happen if it’s de-federated or just drops offline randomly like mine did.

The Fediverse and ActivityPub will continue to evolve, but unlike SMTP, they were created after the internet became adversarial. This author isn’t the first to try to fearmonger over the future of AP, and they won’t be the last.

This isn’t fearmongering, it’s him reviewing the ways SMTP tried to solve the spam problem and became centralized as a result. These questions of how we tackle spam and moderation are valid, important questions. And Fediverse, at a structural level, is basically the same as SMTP. We have users at instances (e-mail hosts), they can send messages/tweets/links (emails) to users on other instances. Each instance is free to accept/reject messages from other instances based on their own criteria. That’s the whole thing. That’s exactly how SMTP works.

And didn’t know it’s possible to defederate an email provider.

It absolutely is, your mail provider “de-federates” aka blocks mail from plenty of other e-mail providers.

Agreed :)

This is an instance moderation problem. If you’re letting spammers in, you need to use a better application process or something similar to that. A big problem with email spam is that most email services allow anyone to sign up for free without any checks.

Which is one reason, this author is arguing, that e-mail has become so centralized. Doing that kind of manual moderation and curation is expensive, the bigger instances out-compete the smaller ones who don’t have as much resources to dedicate to it. As more and more instances get “de-federated” for not having as good of anti-spam measures as the bigger instances, more users will sign up at big instances to avoid defederation risk. Just like how many people use gmail simply because their email delivery rate is so good. If I send from g-mail, there’s very few servers which will reject my message or throw it in the spam folder. I’d love to run my own mail server, but even as a dedicated sysadmin it’s impossible to get decent delivery rates.

The more anti-spam checks we have, yes we weed out spam, but we also make it accessible to less users as well.

AP has been blessed so far with not having to fight too much spam. Look at very popular, very centralized, very resourced platforms like Facebook, spam is still a problem on their platform despite massive resources put towards fighting it.

Don’t email spammers just spoof the domain or send without a domain?

They do both, depending on the spammer and the type of spam they send. In e-mail, you have an e-mail server, you can use it to send mail to users on other e-mail servers. Each e-mail server can choose to accept or reject email from other e-mail servers based on whatever reason they want. AP/Lemmy/Mastodon is basically identical to this. I’m not sure how exactly bluesky is setup but I get the impression it’s similar. In Nostr, servers aren’t federated (each relay is seperate, if you want to send/recieve content to another user on a different relays you just talk to that relay directly instead of having “your relay” act as an intermediary), but the structure is still pretty similar.

Nostr does have this hashcash type system (requiring proof-of-work to weed out spam), but I haven’t come across any relays that actually enforce it, it will be interesting to see if that changes in time. I also saw a GitHub issue about adding something similar to AP but I think they chose not to implement it.

Domains aren’t free and I don’t think it’s worth it for them to buy a new domain to just be able to spam for a short time again.

Literally what e-mail spammers do.

Agreed defederating can help solve obviously malicious instances, it doesn’t solve spammers abusing good instances. E-mail and AP are very similar at a protocol structure level.

2·4 months ago

2·4 months agoPretty well established case law at this point. If it weren’t, you’d see Tor relay operators, small ISPs, etc being hauled into court constantly.

1·4 months ago

1·4 months agoThere are no protections for me if I unknowingly let some stranger use me as a host or router for CP or some pedo shit. It’s not a risk I’m willing to take. There need to be legal protections in place, like there are for ISPs.

There are, at least in the US. That’s why running a Tor node is legal and so is a coffee-shop sharing their wifi to customers. They are not legally liable for actions of users, they are just routers.

1·4 months ago

1·4 months agoEach network has its own way of addressing this with pros and cons. Personally, idc, I don’t mind being a “router” in exchange for other computers “routing” to me. I don’t mind the idea of sharing my internet connection via wifi with my neighborhood, it should be a resource for all.

The cost of having open communication networks or free speech or privacy or any liberties is that people may use those liberties to do bad things, but I’d rather live in a world where we have liberties that sometimes get abused than in a world without liberties where those who control things get basically unlimited abuse of the same liberties we are not afforded.

10·4 months ago

10·4 months agoAlso it’s worth mentioning the “how to distribute content among peers” problem has mostly been solved and has for over a decade, just that nobody has built out the UX for it for a YouTube clone. Torrents exist, #freenet and #hyphanet exist, #ipfs exists, these are all excellent platforms for storing and distributing content without relying on expensive, centralized hosting. Instead, users share the burden of hosting. There’s a whole category of software that solves this problem in different ways (P2P). Unfortunately, every new generation of developers seems to want to re-invent the wheel instead of using time-tested tech that already exists but just needs a UX refresh or maybe some protocol improvements.

If you have a tube site and it says “to skip ads, install IPFS”, everybody would be using IPFS.

10·4 months ago

10·4 months agoNostr has. Over the last two months alone, their users have “zapped” (tipped/donated) other users around 950K (nearly 1 mil!) USD worth via lightning and that number continues to grow. And it doesn’t just make it easy to pay content creators, but to also put a portion of your “zaps” towards the relay you use or development of the software if you want. If you have a nostr account, you can easily tie it to a lightning address to send/receive tips, nostr doesn’t take a fee. Relays can also portion out a bit of their zaps for the people who publish the most engaging content on their relay. The possibilities are quite extensive. And because it’s over lightning, zaps happen instantly and for pennies or less in fees. Though, you can use nostr without zaps at all.

For those unfamiliar with nostr, it’s a decentralized social media software much like ActivityPub/mastodon, the main use right now is as a twitter/instagram clone but there’s also a reddit-style section being built up as well. Moderation abilities from the perspective of the instance/relay are identical. But one bonus if that if your relay goes down, you don’t lose your identity, since your identity and relay are separate. And if you change apps or relays (you are typically connected to multiple relays), all your content moves with you seamlessly. And the payment/zap infrastructure is all decentralized, relays don’t ever custody or manage the payments. If you tip a content creator, it goes directly from you to them. The lightning network has basically limitless transaction capacity. If you have cash app, it supports lightning, so you can already send zaps (you will need different apps to receive zaps though because cash app doesn’t support the LNURL standard). Strike natively supports it. And because it’s lightning, it works in every country automatically.

Long-term, if I am a content creator, which “fedi”-type system is going to be attractive to me? One where users can send me tips and mircopayments or one where they can’t? This is why I think nostr is going to win out long-term over AP/Mastodon. Mastodon could add this kind of functionality but I don’t get the impression they’re open to it. People may not want to commit to yet another $5/month subscription to a YouTuber’s patreon or nebula or whatever, but they are happy to tip 1-10c after watching a video. So there’s a psychological beauty to micropayments as well. As some random person I have made like 7c on tips this month, but I’ve also given out plenty to other people.

Source about nostr fees: https://lemmy.ml/post/17824358

3·4 months ago

3·4 months ago

You can make as many Bitcoin addresses as you want. You can look up an addresses balance but not a wallet’s balance. It’s not as clear as you’re making it sound.

Bitcoin over Lightning is much, much more opaque, and it’s where the majority of Bitcoin transactions are now occurring. You can’t look up somebody’s balance. The only people who know about the transaction are you, the recipient, and any intermediary nodes used to forward the transaction. Privacy is continuing to improve on lightning and main chain.